Boom Technologies Ltd ($BOOM)

An Unmatched Equity Investment Opportunity For Retail & Institutional Investors

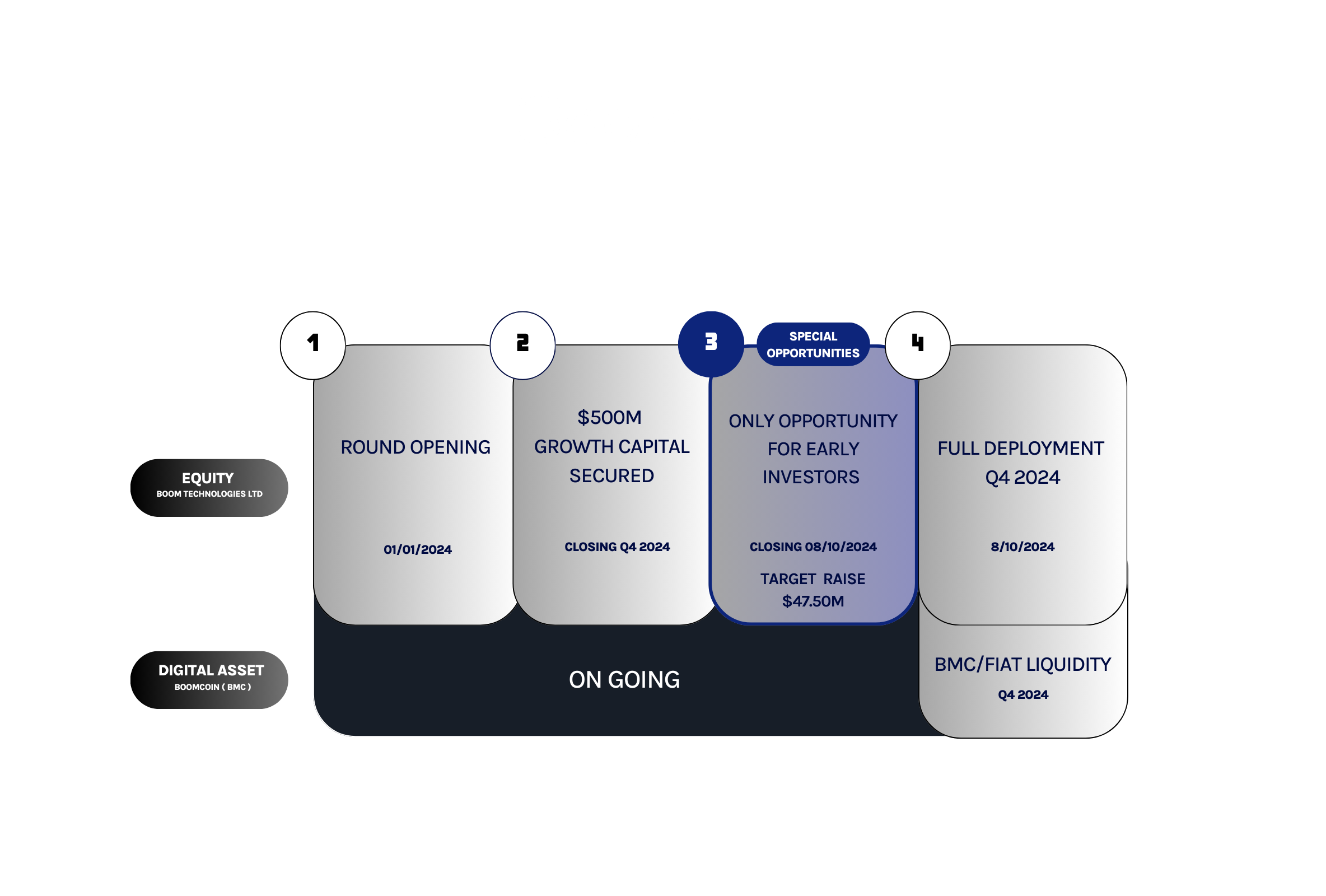

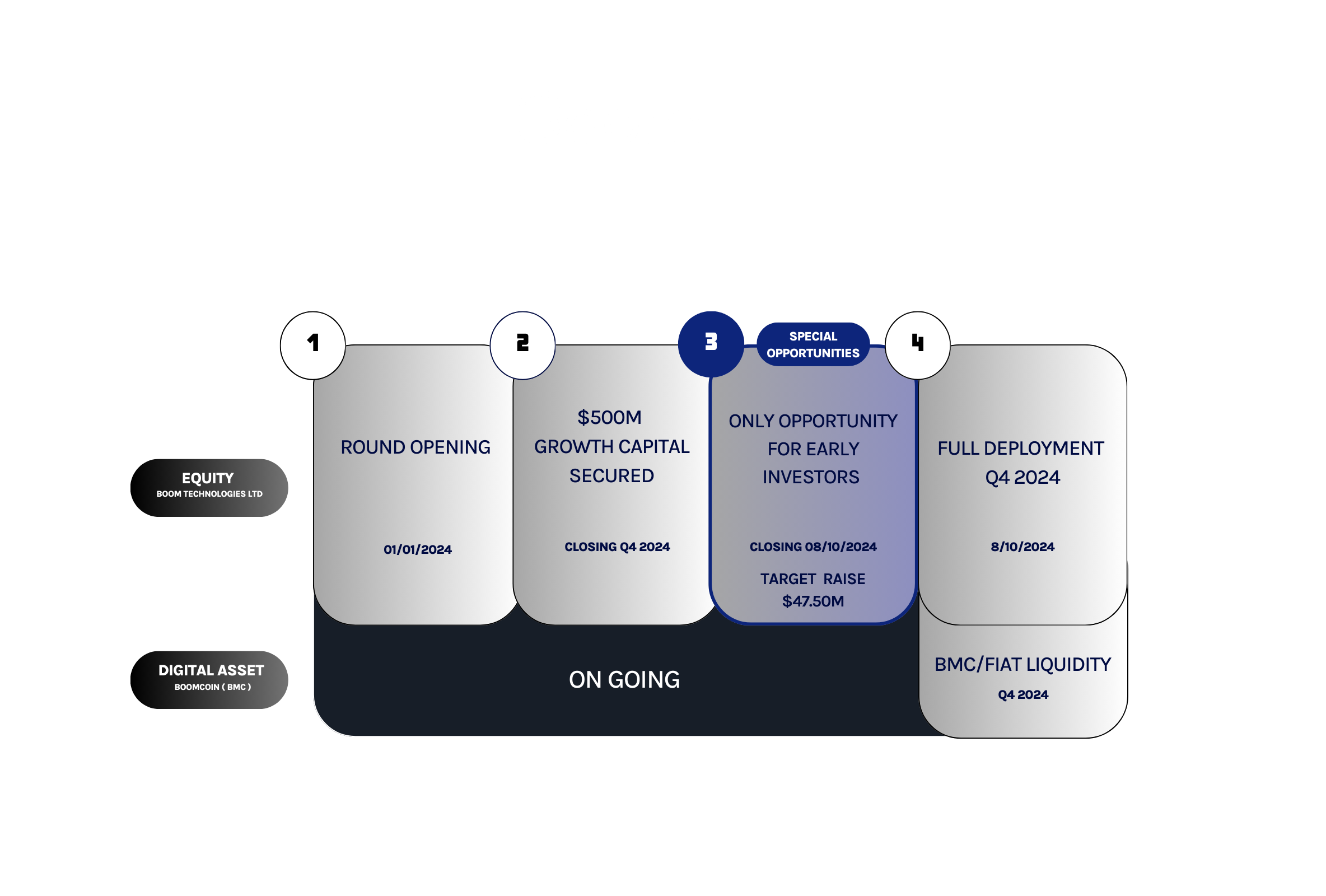

After successfully securing $500 million in growth capital from a major Dubai-based family office, Boom is now offering retail and institutional investors the opportunity to acquire its equity, using cryptocurrency and cash.

View Prospectus

View Prospectus

Investment Details:

- Minimum Investment for retail investors: $25,000

- Minimum Investment for institutional investors: $250,000

- Accepted Currencies: All Fiat & Crypto

- Target Raise: $47.50m

- Bonus: First $5m enjoy a 10% bonus

- Window: From 8/8/2024 to 8/10/2024

Boom anticipates a potential return on investment of up to 500x over five years, making this an unparalleled opportunity for growth.

Fill out the investor enquiry form to accept the details or contact our Investor Relations Team at ir@boom.market and be sure to whitelist this email address.

Fill out the investor enquiry form to accept the details or contact our Investor Relations Team at ir@boom.market and be sure to whitelist this email address.

INVESTOR ENQUIRY