90% of all transactions in Africa, Latin America and South East Asia are cash based. This means that Governments are losing out of VAT revenue. On Boom, VAT is collected off all transactions

Why is Boom interesting for

Governments and Central Banks?

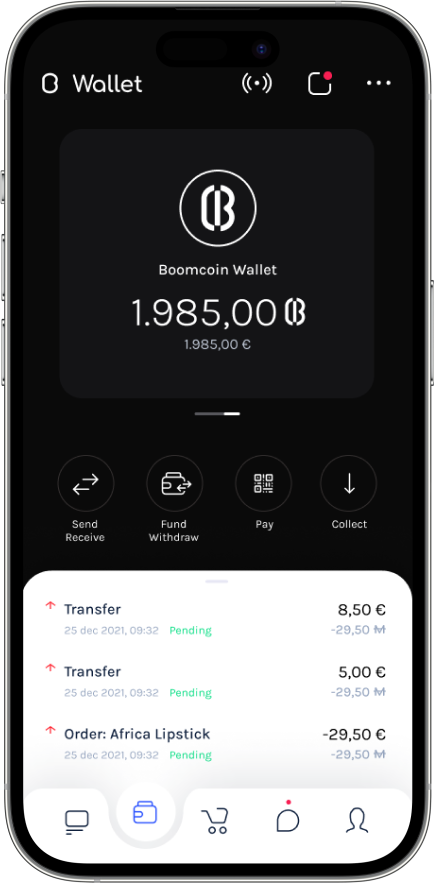

Liquidity Provision & Fiat Custody

As the issuer of banknotes, the sole risk-free asset in the financial system, Central Banks are Boom’s Liquidity Provider partners and the custodians of the cash deposits that serve as 1-to-1 collateral for all the tokenised currencies within the Boom DeFi Ecosystem. Thus, all transactions within Boom are ultimately settled in central bank money via RTGS interoperability with the Boom blockchain.