Understanding Boomcoin DATs vs. Boomcoin ETFs

As we prepare for the Boomcoin Digital Asset Treasury (DAT) Company listing, it’s the perfect time to explore what a Boomcoin DAT is, how it works, and how it differs from a Boomcoin ETF. Both structures provide exposure to Boomcoin, but they do so in very different ways, each with unique risks and benefits.

What Is a Boomcoin DAT Company?

A Boomcoin Digital Asset Treasury company is a standard operating corporation that chooses to hold Boomcoin as part of its corporate treasury strategy. Unlike an ETF, a DAT company is an active business that allocates part of its assets—whether from cash reserves, operational profits, or raised capital—to purchase and hold Boomcoin.

Balance Sheet Overview

A typical Boomcoin DAT company includes:

- • Assets: Boomcoin holdings, cash, property, equipment, intellectual property, and other

investments.

- • Liabilities: Debt, loans, convertible notes, accounts payable, and other obligations.

- • Shareholder Equity: Common stock, additional paid-in capital, retained earnings, and accumulated other comprehensive income.

Importantly, the Boomcoin holdings do not directly back the company’s shares. Investors own equity in the company, not claims on the underlying Boomcoin.

How Investors Value a Boomcoin DAT Company

Investors generally look at three main factors when valuing a Boomcoin DAT company:

- NAV-style assessment of Boomcoin holdings

Analysts estimate the value of the Boomcoin reserves and subtract any debt used to acquire them, producing a Boomcoin-adjusted net asset value. - Valuation of business operations

Investors evaluate revenue, margins, EBITDA, free cash flow, and growth potential. For some DAT companies, Boomcoin holdings may represent a significant portion of total value if operating profits are limited. - Market premiums or discounts

Because shares are not redeemable for Boomcoin, the market price may trade above or below the Boomcoin NAV. Premiums often reflect investor confidence in management or strategic direction, while discounts may indicate concerns about debt or governance.

How Boomcoin DAT Companies Acquire Boomcoin

Boomcoin DAT companies acquire their treasury in a combination of ways. They allocate operating cash flow toward purchases, may raise funds through equity issuance or debt, and use these proceeds to acquire Boomcoin.

In the early stages, the Boomcoin DAT will primarily purchase its BMC from existing holders on the secondary market, allowing it to build a treasury position immediately. Over time, the DAT plans to scale its holdings further by purchasing directly from sovereign or institutional holders when large-scale allocations become available.

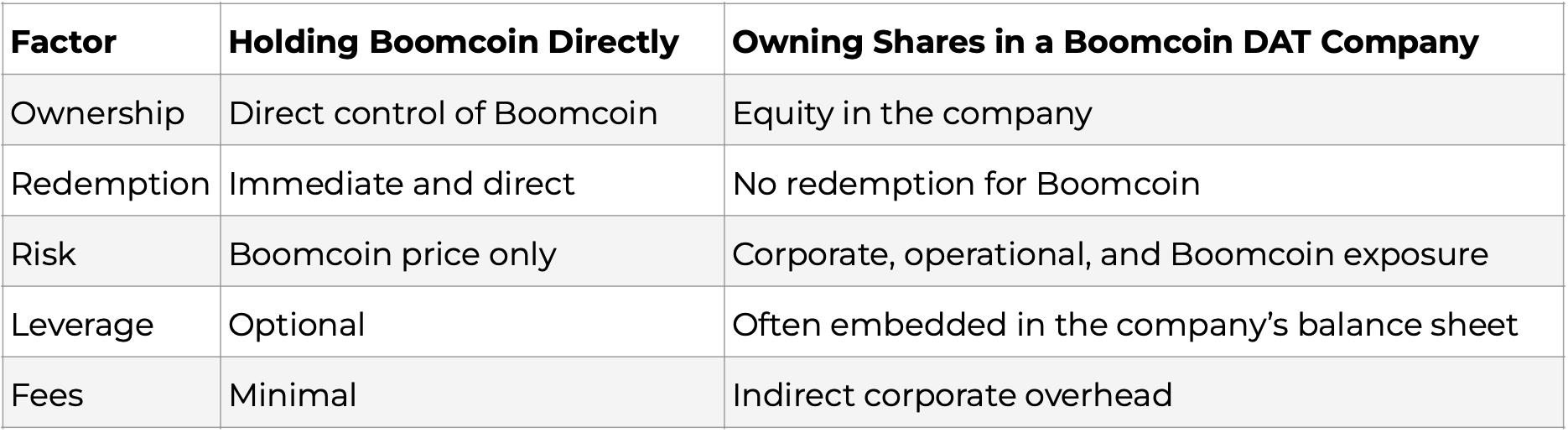

Boomcoin DAT vs. Holding Boomcoin Directly

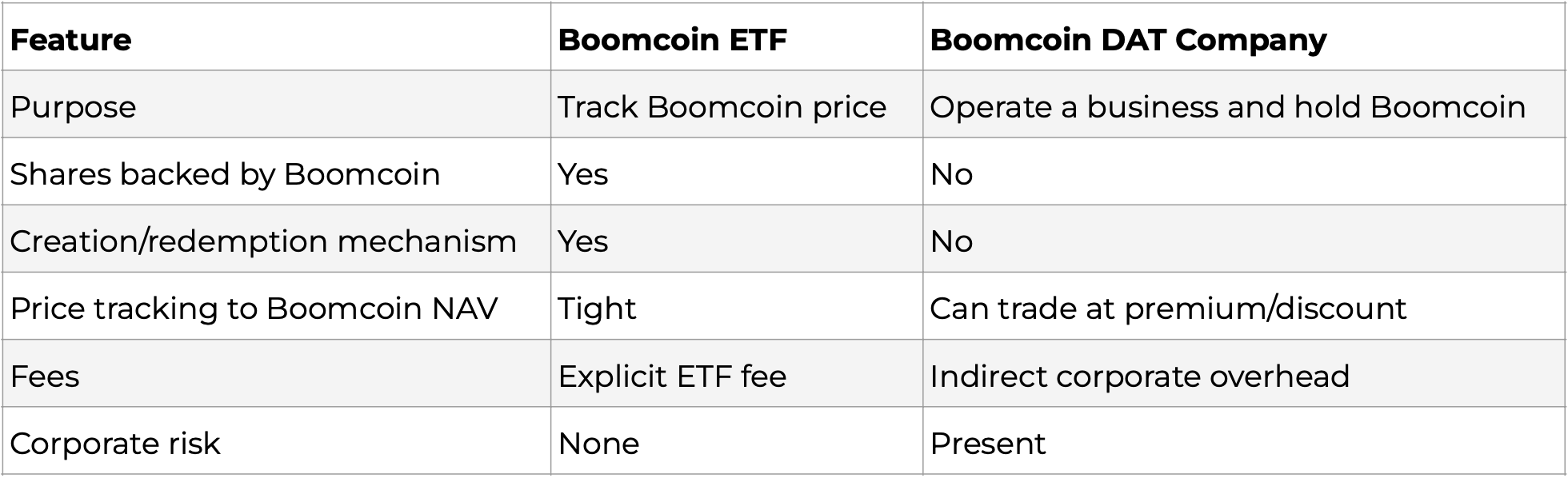

Boomcoin DAT vs. Boomcoin ETF

A Boomcoin ETF is a regulated vehicle designed to track Boomcoin prices, while a Boomcoin DAT company combines business operations with Boomcoin treasury holdings, resulting in a more complex risk and reward profile.

Why Investors May Choose Boomcoin DAT Companies

Investors may prefer Boomcoin DAT companies for:

- • Leveraged exposure to Boomcoin

- • Combined exposure to business operations and Boomcoin

- • Strategic management of Boomcoin reserves

- • Potential tax or regulatory advantages in some jurisdictions

However, DAT companies carry additional corporate risks, such as leverage, governance, or operational performance, which are not present when holding Boomcoin directly or via a Boomcoin ETF.

Key Takeaways

- • Boomcoin DAT companies hold Boomcoin as part of their treasury but do not issue shares backed by the cryptocurrency.

- • Investors value them based on a combination of Boomcoin holdings and business operations.

- • Boomcoin ETFs, in contrast, are regulated products with shares fully backed by Boomcoin and mechanisms to track NAV.

- • DAT companies provide hybrid exposure but come with additional corporate and operational risk.

The upcoming Boomcoin DAT listing offers a unique opportunity for investors to gain strategic exposure to Boomcoin through an innovative corporate vehicle. Understanding the structure, risks, and valuation of DAT companies is essential before investing.

-The Boom Team