October 03, 2024Blockchain

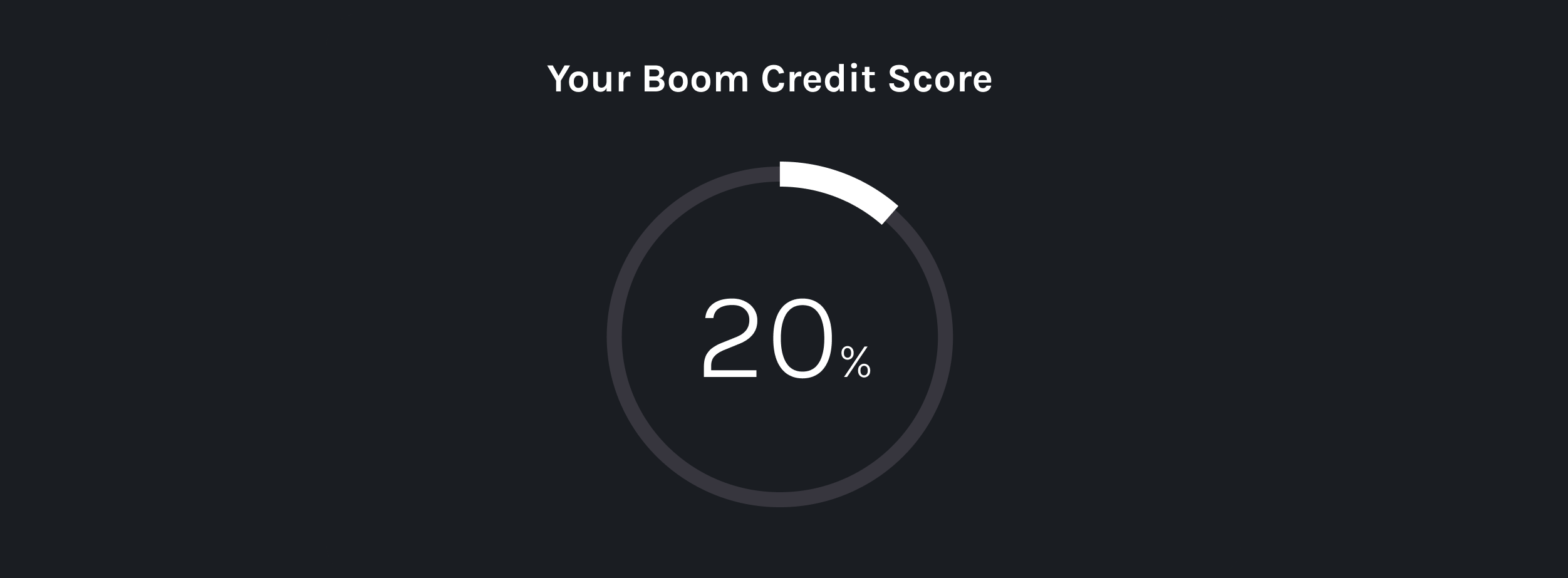

Introducing Boom Credit Score

Making credit accessible for everyone

Billions rely on cash, lacking a banking history for loan assessments. Boom Credit Scores provides a free system that rates your repayment likelihood from 1% to 100%.

A higher score helps you access loans, rent property, lease equipment, and secure better insurance rates. Since cash payments don’t build credit, always pay and be paid through the Boom app to improve your chances of securing loans.

Because your Boom Credit Score is globally available on the Boom blockchain, you will be able to access credit from third-party lenders worldwide.

You can view your score in your Boom Wallet in the latest app release, available in both app stores.

Regards,

The BOOM Team