Boom the company leading Africa into a golden age of decentralised finance and sovereign AI

On a bustling afternoon in Accra, Yao scrolls through his phone while sipping roasted coffee. He smiles as a pair of handmade shoes from Paris lands in his virtual cart. A few taps later - paid entirely in Ghanaian cedis - the order is confirmed.

Across the continent in Nairobi, Monica finalises a payment to her supplier in Abid-jan. Within seconds, the funds transfer in local currencies. No banks, no delays, no intermediaries.

This is not a vision of the future - it is Boom Technologies Ltd, a 100% African-owned company, that is transforming Africa and the world, into a seamlessly connected single digital marketplace without a single currency.

The problem: cash disconnected from the digital world

Africa has long been caught in a financial paradox. Most daily transactions occur offline and in cash, yet the global economy thrives online. Today, over one billion adults and businesses remain unbanked, unable to access the tools needed for digital commerce.

At the same time, £25 trillion in physical cash sits idle outside the banking system untapped and unproductive. The IMF estimates that 90% of transactions in emerging markets still take place in cash, leaving millions excluded from credit, investment and cross-border trade.

Intra-African commerce faces its own barriers. Africans seldom accept each other's currencies, relying instead on US dollars for cross-border payments. The Pan-African Payment and Settlement System (PAPSS), created to solve this challenge, has so far signed up 17 countries. Yet even if all 44 central banks in Africa adopted it, PAPSS would still only serve the small fraction of transactions processed through the banking system - leaving the vast majority of cash-first users excluded.

Add to this a deep distrust of banks. Many Africans prefer to custody their own cash, but that comes with risks: theft, portability issues, limited cross-border acceptance and no ability to transact online.

Enter Boom Technologies Ltd

Founded by Nigerian-born technology entrepreneur Peter Alfred-Adekeye and funded with his own $133m in seed capital, Boom was created to make cash as powerful as digital money.

Boom is a decentralised financial market infrastructure that allows anyone to spend cash online, worldwide, without needing a bank account.

"Boom is the world's decentralised financial operating system, unlocking access to $1,000 trillion in real-world assets, while enabling value exchange across currencies, commodities and securities without banks, borders, or permission," says Alfred-Adekeye. "We have built the software infrastructure for Africa's golden age of commerce."

How Boom works for everyday Africans

For Yao in Ghana, Boom means he can buy from European brands using local currency. For Monica in Kenya, it means paying suppliers in Abidjan instantly and securely - no dollar conversions, no friction.

At the heart of this innovation is Boom's seven-layer decentralised finance (DeFi) stack, anchored by the Boom blockchain at Layer 1, the Boom Superapp at Layer 4 and developer-friendly APls at Layer 7

This architecture allows users to controll their funds while enabling instant, cross-border payments in local currencies.

The Boom Superapp: four world firsts in one

The Boom Superapp is a Web3-powered platform designed with a seamless Web2 user experience. Already available in 15 African languages including Arabic, Yoruba, Amharic, Swahili, Lingala, Igbo, Zulu, Hausa and more (with plans to expand to 300), it combines:

• Self-custodial wallet with built-in POS and Scan-to-Pay

• Marketplace for goods and services - a first for Africa and the world

• KYC-verified messaging platform, offering trust and security in communication

• Social media features, connecting people, businesses and brands

• For merchants, the BoomPay gateway enables cash-to-digital online payments at checkout, with instant account-to-account settlement worldwide.

Global recognition: BIS collaboration

Boom's credibility was strengthened in 2023 when it successfully collaborated with the Bank for International Settlements (BIs) - the central bank of central banks - through Project Rosalind, led by the Bank of England. This partnership positioned Boom not only as a regional disruptor but also as a trusted player in shaping the future of global payments.

Boomcoin: Africa's sovereign digital asset

At the core of Boom's financial layer lies Boomcoin (BMC), the world's only sovereign-grade digital currency with built-in compli-ance. Every Boomcoin is transparently KYC-traceable from the genesis memory block to today, exceeding AML/CTF standards and providing regulators, institutions and merchants with unmatched confidence.

• Total supply permanently capped at 2bn

• 1.5bn coins available for acquisition at the rate of 10m per country - for sovereign wealth funds, central banks and institutional investors

• 50m coins allocated to the Boom Foundation for philanthropical social impact initiatives.

The Foundation's Boomcoin-to-Meals pro-gramme has already airdropped BMC to

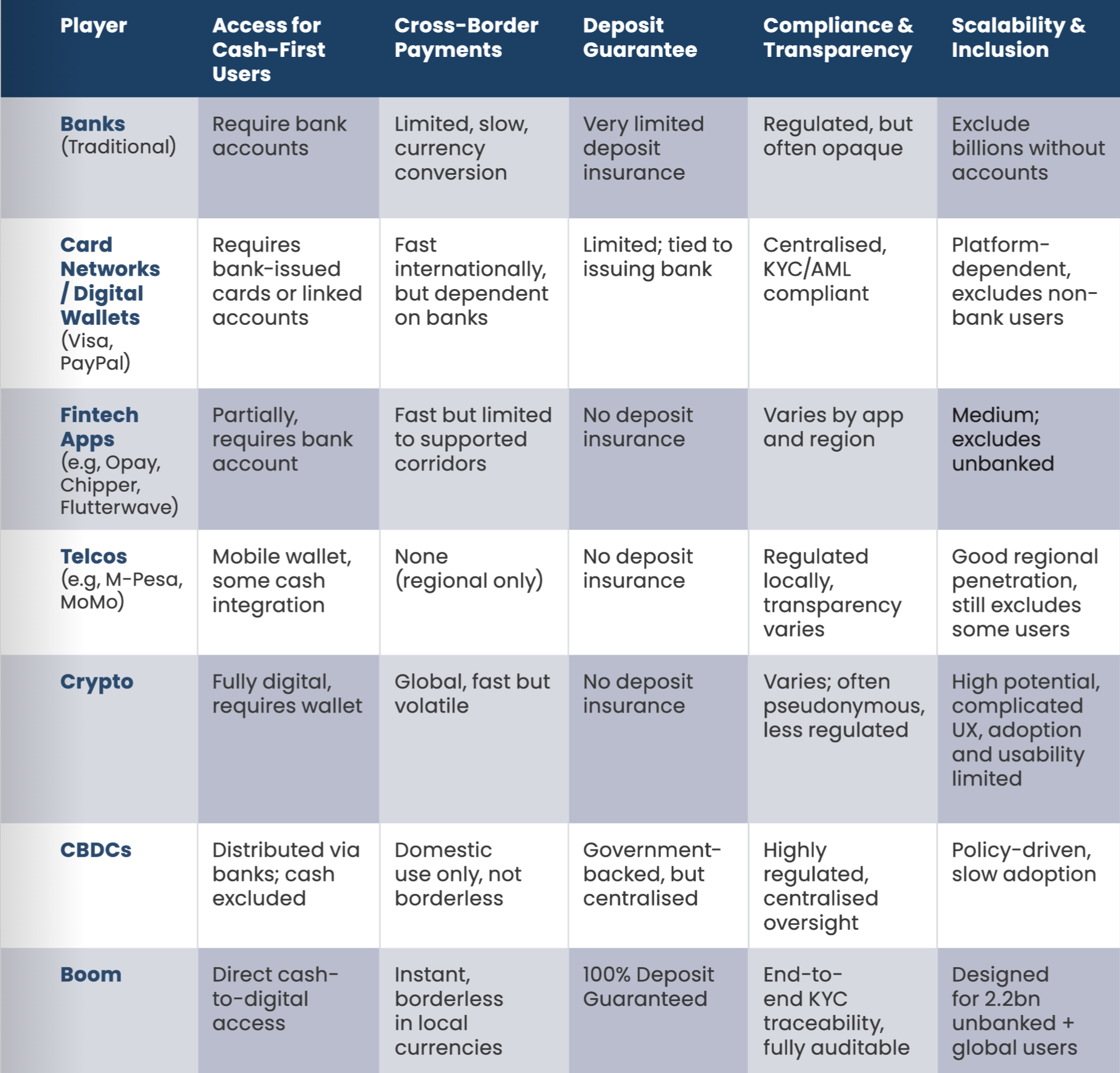

Gap analysis: why Boom stands apart

PhotonAl: pan-African Artificial General Intelligence

Boom's ambition stretches far beyond payments. Its PhotonAl initiative tackles Africa's existential challenge: the lack of sovereign Al infrastructure.

Currently, Africa contributes less than 1% of global Al training data and lacks large-scale compute power, leaving it vulnerable to digital colonisation.

PhotonAl aims to change this by building decentralised, gigawatt Al data centres across all 54 African nations, with the first three set to go live in 2027.

By 2031, PhotonAl is projected to: add $3 trillion to Africa's GDP; create millions of jobs; and support im developers, 100,000 Al startups and 5m tech jobs.

All access to compute, storage and models will be paid in local currencies via BoomPay. A decentralised design ensures resilience, redundancy and sovereignty, giving Africa a voice in the next era of gene AI.

Investment and IPO opportunities

According to insiders, Boom is preparing for IPOs in London, New York and Africa. The Boomcoin Treasury Company (BTC) will soon list in New York, providing regulated exposure to BMC.

For the first time, a pre-IPO equity round will also be opened to African investors, allowing them to participate directly in what could become the continent's first trillion-dollar tech company.

Africa's new digital era

With 10m verified users expected within 12 months and up to 300m by 2030, Boom is building the largest pan-African digital financial ecosystem in history.

By connecting £25 trillion in idle cash to the digital economy, Boom has effectively turned Africa into a single borderless market - without a single common currency.

For Yao, Monica and millions of others, what once seemed impossible is now a daily reality. Africa's golden age of decen-tralised finance and Al has begun - led by Boom

Source: https://heyzine.com/flip-book/097a32047e.html#page/83